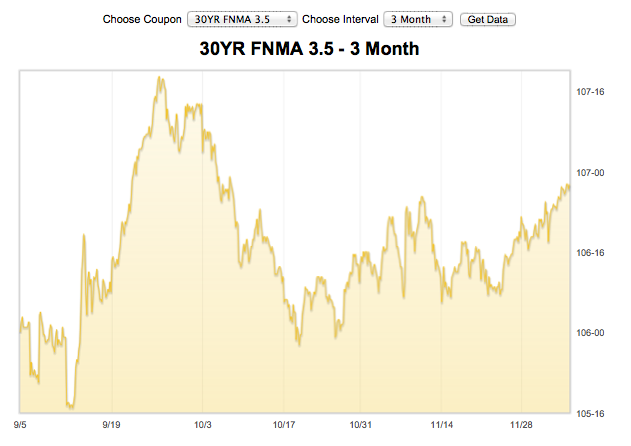

Ever wonder why interest rates on mortgages rise and fall? They can move multiple times in one day. WHAT CAUSES THAT? – One of the instruments a great broker uses to anticipate the mortgage shifting is to watch the Mortgage back Securities markets. Take a look at the MBS chart, its rather interesting that the rates are opposite the MBS tracker. When the MBS go up rates go down and vice versa.

While one doesn’t control the other, skilled brokers use this tool to get borrowers like you the best rates at the perfect time! Banks have no idea about this and don’t offer this benefit. Rate shift explained below.

Why do Rates Rise and Fall? One of the answers is 'Risk' - Mortgages are effectively a fixed income security that carries some risk of default. The rate of interest they you pay on a mortgage depends on a number of factors, some you can control and others that you can't. Factors that you can control include your credit history and your down payment. The better your credit history, the less risk you pose to the lender. The higher you’re down payment, the more likely the lender will be able to recover its investment even if you default.